2019 Real Estate Review & Forecast

In real estate, winter is always a time of reflection and anticipation. What can we learn from the previous year, and what should we expect our local market to do in the year ahead?

We’re fortunate to have the expertise of Windermere Economist Matthew Gardener and Dr. Neil Johnson of Sound Resource Economics and Tacoma Pierce County Chamber to draw upon, and we’re here to share an overview of the data that was presented to our real estate agents at our WPP 2019 Kickoff Meeting. Whether you’re a homeowner and planning to sell or you’re ready to buy, keeping an eye on how the market is doing on both a local and national level can help you make the best decisions possible along the way!

Pierce County Review & Forecast

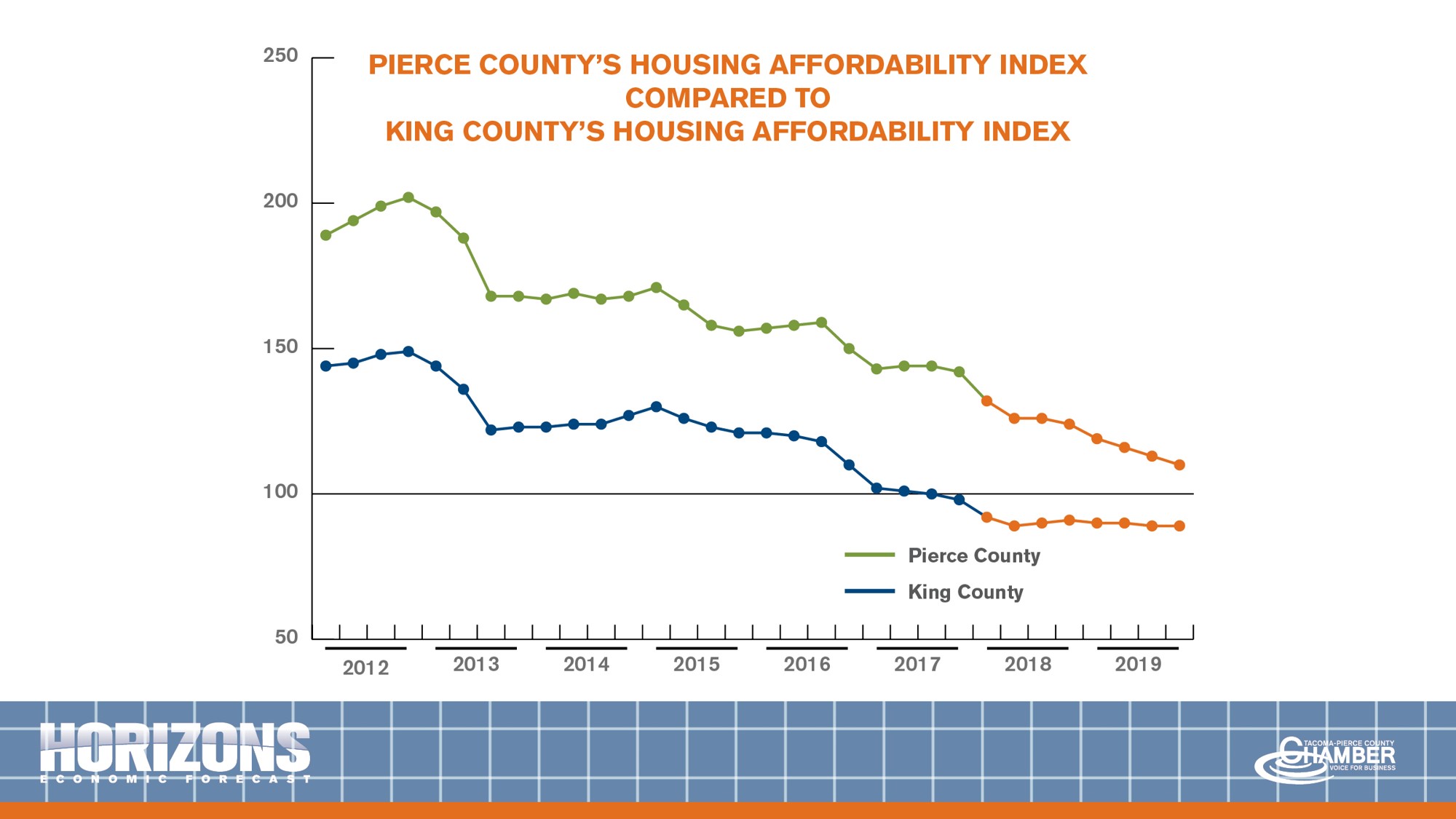

2019 is certain to bring us another year of growth in Pierce County: “Growth in Pierce County is likely to be driven by population increases partially due to the lower cost of housing relative to King County,” says Dr. Neal Johnson. As you’ll soon see, the numbers back up this observation.

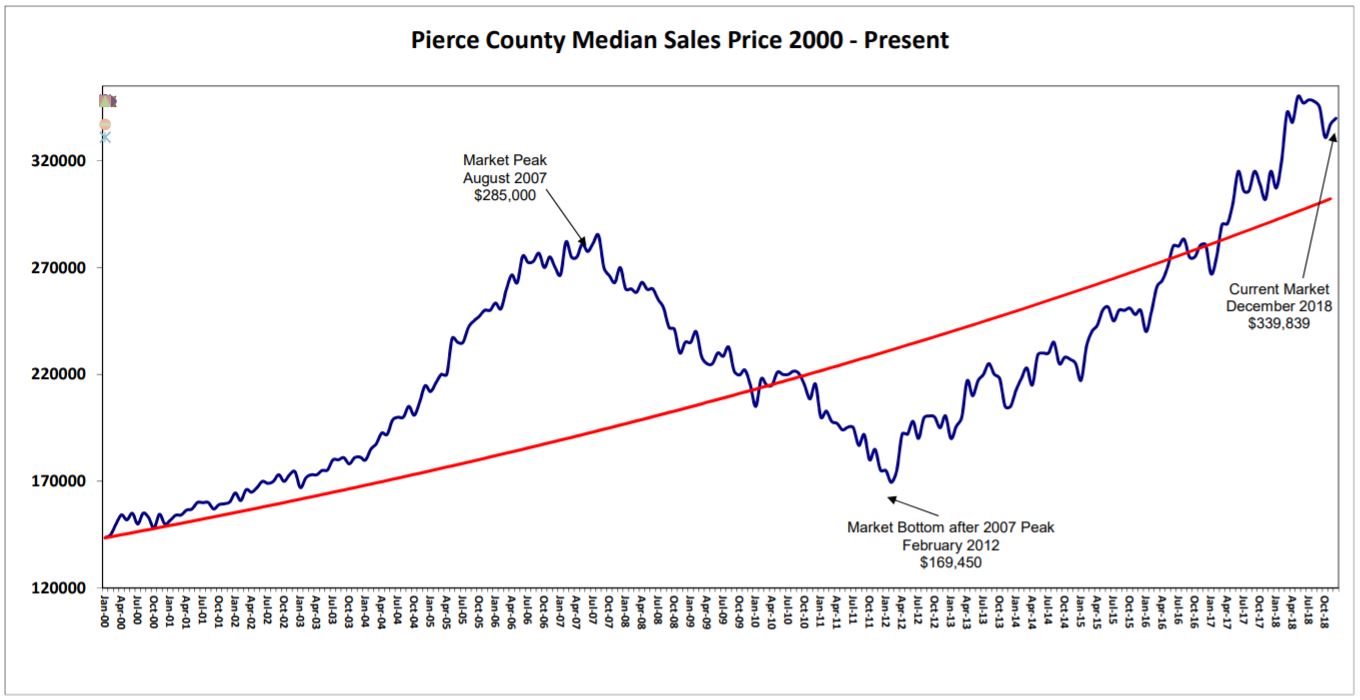

This is great for the many commuters who are moving south to Pierce County. As you can expect, this is driving up median home prices. In 2017, median home prices were at $300,000, and in 2018, the median price was up to $340,000, a 13% year over year increase.

The average home in Pierce County is currently 45% less expensive than the average home in King County. (The King County median home price of $620,000 vs. the Pierce County median home price of $340,000.)

King County affordability has been in negative territory for going on 3+ years, while Pierce County is still above 100. So while Pierce affordability has been eroding these last 6 or 7 years it is still attractive when contrasted to King.

One big effect of the increase in sale prices is that Pierce County rent prices have followed suit and were up over 11% in 2018. Rental affordability is becoming part of the conversation in Pierce County. This two edged sword is making it very dificult for low income renters, while investors are seeing new opportunities in properties that were not otherwise viable. They are making extensive rennovations and repairs allowing for a greater return on investment. The dynamics of these changes have brought the attention of civic leaders and the implementation of new landlord/property owner regulations that some consider controversial.

One big effect of the increase in sale prices is that Pierce County rent prices have followed suit and were up over 11% in 2018. Rental affordability is becoming part of the conversation in Pierce County. This two edged sword is making it very dificult for low income renters, while investors are seeing new opportunities in properties that were not otherwise viable. They are making extensive rennovations and repairs allowing for a greater return on investment. The dynamics of these changes have brought the attention of civic leaders and the implementation of new landlord/property owner regulations that some consider controversial.

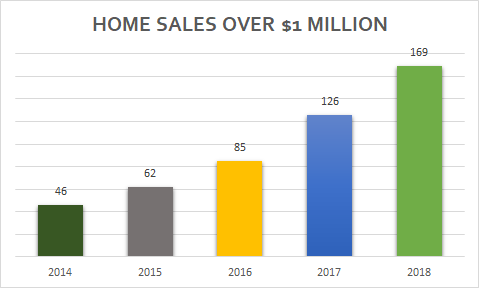

Along with price increases for the average house, we’ve been watching the number of $1 million home sales in Pierce County increase significantly since 2012. Specifically, they were up by 34% as measured between 2017 & 2018, as seen in the graph below. The luxury market in Pierce County is on the rise and starting to capture the attention of a wider audience.

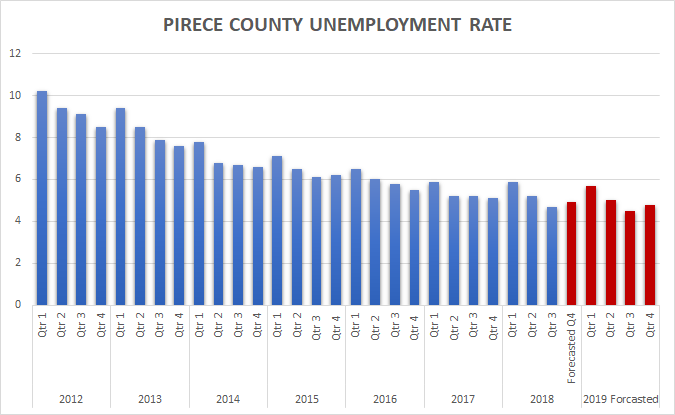

Unemployment in Pierce County has also steadily gone down since 2012, finishing last year around 4.7%. And new developments are great news for our local economy and continued employment opportunities. The Greater Tacoma Convention Center is adding a $43 million hotel, the Tacoma Dome recently completed a $30 million renovation, the Emerald Queen Casino is finishing a $220 million expansion, Pierce County is positioned to share the construction of the Boeing MMA, Point Ruston is still expanding, the Washington Building is converting to apartments, the Brewery District is an exciting up and coming project, McMenamins in Tacoma will be opening in April 2019, new apartments near Freighthouse Square are set to open in 2019, the Port of Tacoma is adding 4 new super-sized cranes, and talk continues on a new City Hall development.

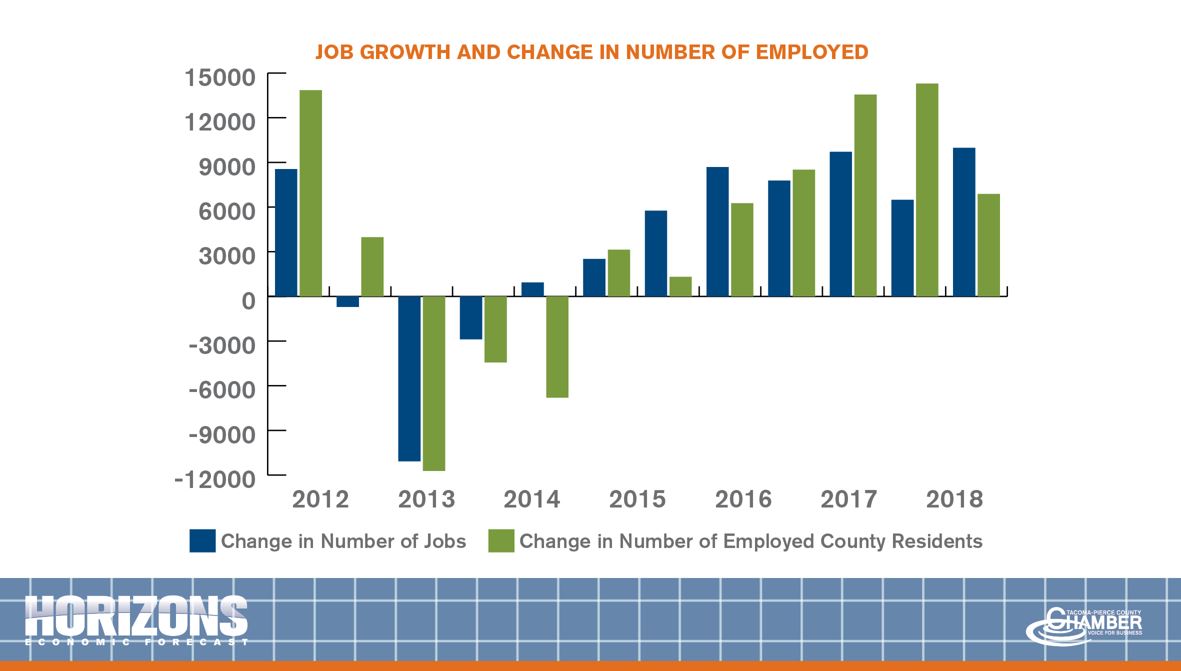

The graph below shows that in 2018 Pierce County added more jobs than employed county residents. This is the first time in four years that has occurred! This is exciting as perhaps jobs are coming to the people, rather than people going to the jobs.

U.S. Review & Forecast

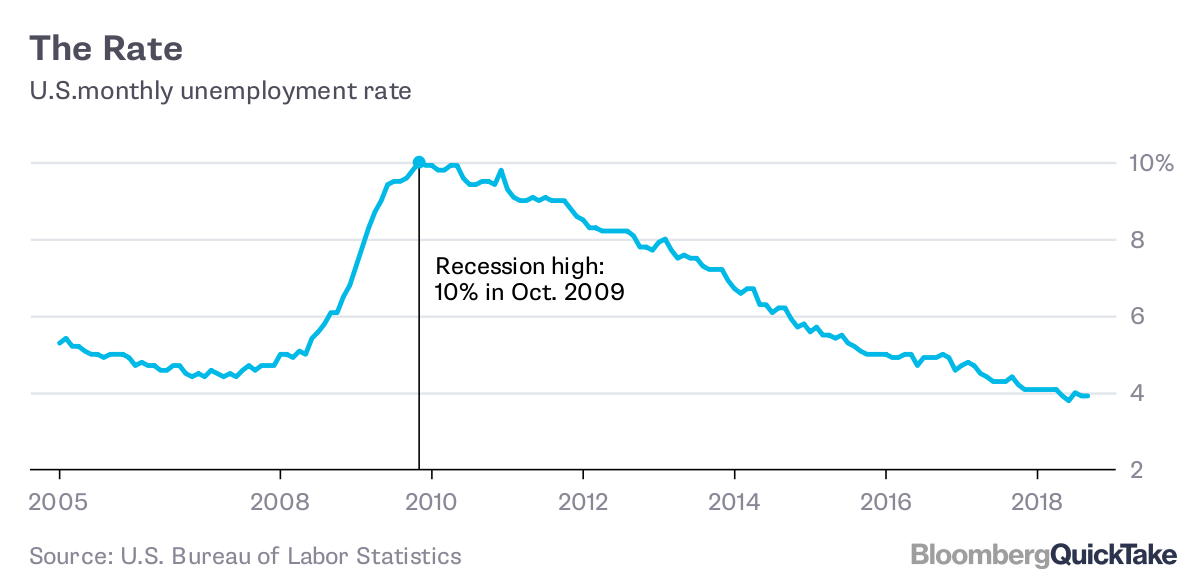

2018 saw over 2 million jobs added nationally, and there are still 7 million unfilled jobs. The U.S. has added jobs for 99 months straight as of now, and employment growth is expected to continue into 2019. In 2018 we saw the unemployment rate dip below 3.9%

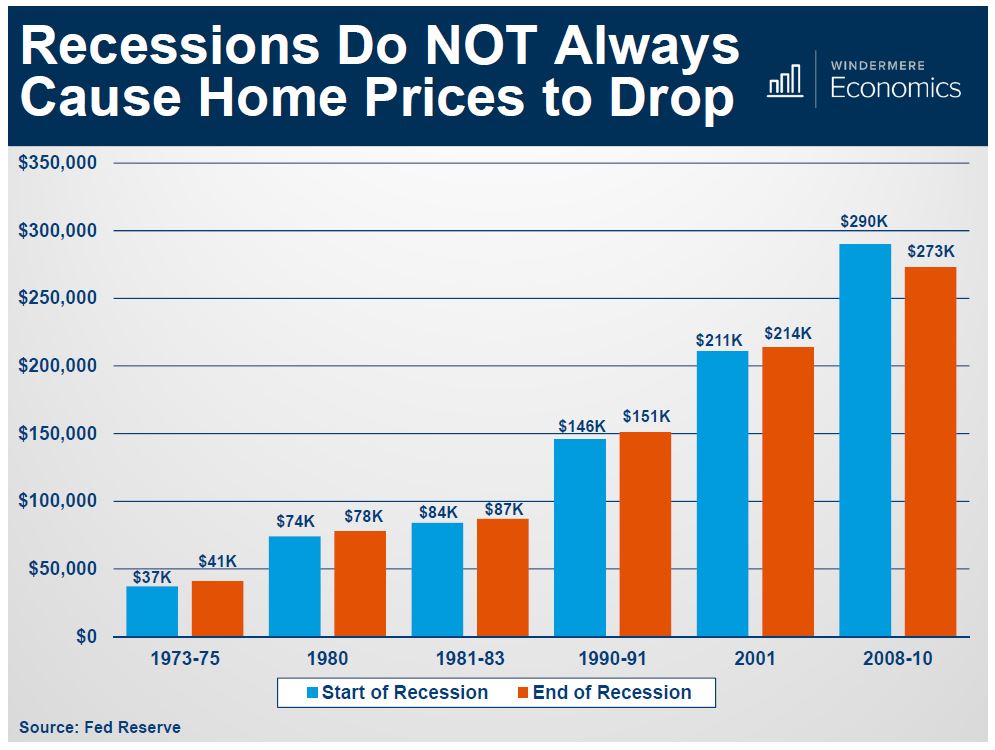

Eventually we will have a mild recession. Most experts are predicting some time in 2020. It won’t be anything like the last one, and it won’t be housing driven. That said, recessions have not historically had a huge influence on housing prices.

We find ourselves in a goldilocks zone, balancing threats and opportunities. While things are on the up-and-up in terms of national employment, there are a few potential threats on the horizon, including the effects of the government shutdown, federal rate increases, tariffs, and lower personal consumption. The health of the housing market is balancing these threats with high housing demand, high borrower credit rating, steady mortgage debt, low delinquency rate (around 3% right now), and millennial home buying on the rise. With the recent years of strong appreciation, America has built up over $15 trillion in housing equity. This will serve as an excellent safety net as we encounter future economic bumps.

This 2019 Real Estate Review and Forcast Blog is the culmination of Realtor® and Owner, Michael Robinson's presentation at the Windermere Professional Partners 2019 Kickoff event, keeping our brokers up to speed on the housing market and economic trends. If you have questions, you can reach out to Michael Robinson here.

If you have questions about your home value, a particular market or you are considering purchasing a home, Windermere Professional Partners can help you find an agent here.